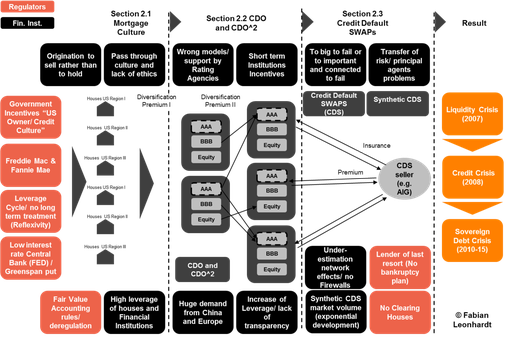

This graph only represents the limited perspective of the author and further underlying causes in the complex financial world could be missing. We must learn to be aware of our own fallibility.[1] The progress of knowledge is framed not just by what we know, but also by gaining a better understanding of what we cannot know.[2] This could be also a direction for the future. Nassim Taleb argues that we need a system becoming stronger and not weaker from random shocks.

“Meanwhile, over the past few years, the world has gone the other way, upon the discovery of the Black Swan idea. Opportunists are now into predicting, predictioning, and predictionizing Black Swans witheven more complicated models coming from chaos-complexity-catastrophe-fractal theory. Yet, again the answer is simple: less is more; move the discourse to (anti) fragility.” (Taleb, 2012, pp. 138-139)

A way into this direction might come from Katharina Pistor arguing for the implementation of more natural firewalls coming out of the system[3] (including ideas from the Glass-Stegall act, Volcker rule). This process is still in development but might be more stable over the long run than a central regulation. Still beside the Rogoff and Reinhart analysis a further lesson is that government regulation with clear long term targets is difficult to implement.[4] Additionally it is important to avoid reflexive influence of the financial markets on its own regulation[5], while still pursuing more global coordination among regulators. Regulation of the OTC market particularly new derivatives is an issue for further research, while currently the regulation of OTC markets is already in progress and could be combined with the purpose of creating ceilings[6]for leverage.[7] Finally the importance of behavioural aspects should not be underestimated and a simple solution here is that decision makers need more skin in the game.

[1] As the German physicist Werner Heisenberg’s states in his uncertainty principal, the root of the problem was man’s examination of nature, which inevitable impacts the natural phenomena under examination so that the phenomena cannot be objectively understood. (Bookstaber, 2007, pp. 223-224)

[2] (Soros, 2008, p. 69) and (Bookstaber, 2007, p. 220)

[3] (Pistor K. , 2012)

[4] See (El-Erian, 2013), (Taylor, 2011, p. 22)

[5] See (Soros, The New Paradigm of Financial Markets: The credit crisis 2008 and what it means, 2008)

[6] Contrary the provision of better liquidity buffers and supporting more leverage during crisis is also necessary and is a further issue (Geanakoplos J. , Solving the Present Crisis and Managing the Leverage Cycle, 2010, p. 123)

[7] See (FSA, 2012)

Write a comment