Nassim Taleb recently published a lecture on “tail risk”. Here the link to the document: http://www.fooledbyrandomness.com/FatTails.html

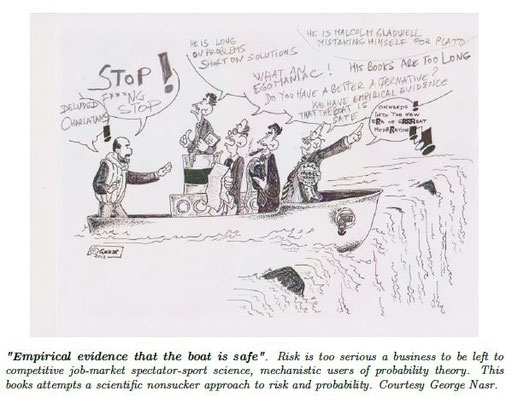

The cartoon on the front (see below) provides a good picture of what happens when you argue against the basic “gaussian” thinking of finance theory. Current portfolio theory is more and more moving towards risk parity strategies (which are putting risk at their heart including other risk factors than volatility) such as the one proposed by AQR Capital management. The best people in finance are actually often betting against the theories taught in universities (and are probably still thankful that universities keep teaching it). Warren Buffet sold a huge amount of long term put options after the financial crisis to gain liquidity investing into undervalued securities. Doing this he was actually making money out of human psychology (people overpay for insurance and lotteries as well) and betting against the Black Scholes pricing mechanism for options, which is not the heuristic traders use, but which is still a wrong anchor value (based on “Gaussian” thinking) for many derivatives. A key message I took away from Taleb is that more complexity does not help to find a good solution. Simple heuristics could do a better job. For example building a simple heuristic to detect convexity could be enough for many problems rather than trying to use complex forecast mechanisms. The knowledge that something is convex should offer enough information to handle a problem differently (think about population growth, climate change and technical process).

You do not have to be the smartest guy in the room for successful investing. More important is being aware of your own stupidity and betting on the fact that a lot of “smart people” will get it wrong.

Write a comment

bestessays.com.au reviews (Wednesday, 03 January 2018 04:32)

Warren Buffet sold a huge amount of long term put options after the financial bestessays.com.au reviews to gain liquidity investing into undervalued securities. Doing this he was actually making money out of human psychology.